| Uploader: | Futureshorts |

| Date Added: | 17.08.2018 |

| File Size: | 57.77 Mb |

| Operating Systems: | Windows NT/2000/XP/2003/2003/7/8/10 MacOS 10/X |

| Downloads: | 42515 |

| Price: | Free* [*Free Regsitration Required] |

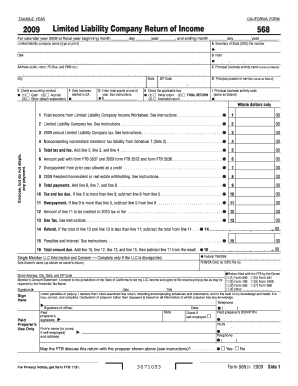

Printable California Form (Limited Liability Company Return of Income)

Form Fill out, securely sign, print or email your california form instantly with SignNow. The most secure digital platform to get legally binding, electronically signed documents in just a few seconds. Available for PC, iOS and Android. Start a free trial now to save yourself time and money! To view or download instructions and Form , Limited Company Return of Income, go to blogger.com and search for form To register or organize an LLC in California, contact the California Secretary of State (SOS): Website blogger.com Telephone By Mail CALIFORNIA SECRETARY OF STATE DOCUMENT FILING SUPPORT PO BOX (See Exceptions to Filing Form in the Form Limited Liability Company Tax Booklet, General Information D, Who Must File). Nonregistered foreign partnerships that are a member of an LLC doing business in California or a general partner of a partnership doing business in California are considered doing business in California and.

Ca ftb 2018 form 568 booklet download pdf

JavaScript seems to be disabled in ca ftb 2018 form 568 booklet download pdf browser. You must have JavaScript enabled in your browser to utilize the functionality of this website. Paying Your Taxes. Privacy Notice. Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.

Follow the simple instructions below:. When the tax period started unexpectedly or you just forgot about it, it could probably create problems for you. The only thing you need is to follow these easy guidelines:. In case of misunderstandings, turn on the Wizard Tool.

You will receive useful tips for simpler submitting. Click on Done to finalize editing and choose how you will send it. You have the opportunity to use virtual fax, ca ftb 2018 form 568 booklet download pdf, USPS or e-mail. It is possible to download the record to print it later or upload it to cloud storage like Google Drive, OneDrive, etc. Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Watch this brief video to get answers on many questions you will have while completing the nonresident. Save time and effort for more important things with these short guidelines. Determine the portion of income reported on your federal tax return that was earned or received from California sources while you were a nonresident.

Form is used by California residents to file their state income tax every April. This form should be completed after filing your federal taxes, such as FormForm A, or Form EZ, because information from your federal taxes will be used to help fill out Form Form DE9C is the quarterly wage and withholding report for California employers. The form is used to report wage and payroll tax withholding information for California employers.

In a way, it is the California equivalent of the Form except the detailed withholding for each employee is reported. DE9 is to pay taxes and DE 9C is to declare your employees wages and taxes paid. The agency reports the number of wage items on the ETA report; this count is one of the workload items used to allocate UI administrative funds. Wage item validation assesses the accuracy of the count of wage items reported on theand alerts the state to correct any inaccuracies.

Wage report is a quarterly report by a subject employer record the wages of each individual worker in employment during the quarter. Payroll quarters are Jan.

The due date for quarterly payroll reports is typically a set number of days after the end of a quarter. Most people are required to file a state return in California, even with minimal income, but what about a federal return?

The answer depends primarily on your age, income, and filing status. Generally, you must file an income tax return if you're a resident, ca ftb 2018 form 568 booklet download pdf resident, or nonresident and Receive income from a source in California.

California does not require your business to file a or form in addition to the federal filing requirement. The minimum income amount depends on your filing status and age. If your income is below that threshold, ca ftb 2018 form 568 booklet download pdf, you generally do not need to file a federal tax return. News Affected by the California wildfires?

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms. USLegal fulfills industry-leading security and compliance standards. Ensures that a website is free of malware attacks. Highest customer reviews on one of the most highly-trusted product review platforms. TopTenReviews wrote "there is such an extensive range of documents covering so many topics that it is unlikely you would need to look anywhere else".

USLegal received the following as compared to 9 other form sites. US Legal Forms. Help View Your Cart. Just Honest People. Online Chat. How It Works. The only thing you need is to follow these easy guidelines: Open the file with our powerful PDF editor. Include photos, crosses, check and text boxes, if it is supposed. Repeating details will be added automatically after the first input. Never forget to add the date of application. Make your unique e-signature once and place it in all the needed lines.

Check the information you have filled in. Correct mistakes if necessary. Get Form. Video instructions and help with filling out and completing yy Watch this brief video to get answers on many questions you will have while completing the nonresident. Itin FAQ. What is Schedule CA nr? Which CA tax form to use? What is form de9c? What is a de9 and de9c? What is wage item count on de9c? What is a wage report? What payroll reports are due quarterly?

Do I need to file California taxes? Do I need to file state taxes in California? Ca ftb 2018 form 568 booklet download pdf much do you have to make in order to file taxes in California? Do I need to file with California? What is the minimum income to report to IRS? Where do I send my in California? Do I need to send to State of California?

What address do I send forms to? Eitc Related content. Related links form. Get This Form Now! Call us now toll free: As seen in:, ca ftb 2018 form 568 booklet download pdf.

5 California LLC Mistakes to Avoid

, time: 5:19Ca ftb 2018 form 568 booklet download pdf

STATE OF CALIFORNIA. FRANCHISE TAX BOARD. PO BOX , an LLC that is a small business solely owned by a deployed member of the SACRAMENTO CA Form , Limited Liability Company Return of: Income. An LLC must file Form by the th. day of. the 4. th. Page 2 FTB Z Booklet Instructions for Form FTB Z Enterprise Zone Businesses References in these instructions are to the Internal Revenue Code (IRC) as of January 1, , and to the California Revenue and Taxation Code (R&TC). Contents. Read instructions for form ftb state of california and Download Ca Form Instructions. instructions for form ftb this is the amount you expect to enter on the llc’s form , write the california sos file number, fein, and “ Ca Filing Instructions | Complete PDF Library form-weather.

No comments:

Post a Comment